Tax Season 2025 Start Date

Tax Season 2025 Start Date: Get ready, folks! The annual tax tango is about to begin. This year’s tax season promises a unique blend of familiar routines and exciting new twists. We’ll unravel the mystery of the official start date, explore the crucial deadlines, and navigate the ever-evolving landscape of tax laws. Prepare for a journey through the fascinating world of tax preparation, complete with helpful tips, insightful observations, and a touch of humor to lighten the load.

Buckle up, it’s going to be a wild ride!

The Internal Revenue Service (IRS) will officially announce the precise start date for the 2025 tax filing season well in advance. This date typically falls in late January or early February, allowing ample time for preparation. However, understanding the key dates, potential changes in tax laws, and available resources is vital for a smooth and stress-free tax season.

We’ll cover everything from understanding deadlines and penalties to leveraging valuable resources and avoiding common pitfalls. Think of this guide as your personal tax sherpa, guiding you through the sometimes treacherous terrain of tax season.

Official Tax Season 2025 Start Date

Let’s get down to brass tacks: tax season. It’s that time of year again, friends, when we grapple with forms, deductions, and the ever-elusive perfect tax strategy. While the thought might initially send shivers down your spine, remember, we’re in this together! And knowing the exact start date can help you plan accordingly, ensuring a smoother, less stressful experience.The Internal Revenue Service (IRS) typically announces the official start date for tax season several months in advance.

While the precise date for 2025 isn’t yet publicly available as of my current knowledge cutoff, we can anticipate a similar timeline to previous years. Rest assured, once the IRS makes their official announcement, it will be widely publicized through their website, press releases, and major news outlets. Keeping an eye on these channels will provide you with the most up-to-date and accurate information.

Think of it as a treasure hunt – except the treasure is a completed tax return!

2025 Tax Season Start Date Compared to Previous Years

It’s always helpful to see the bigger picture. Understanding how the start date shifts year to year allows for better preparation. While the precise 2025 date remains elusive for now, let’s look at the past three years to get a feel for the typical timeline. Remember, these dates are subject to change based on various factors including legislative updates and IRS operational considerations.

| Year | Start Date | Filing Deadline | Notable Changes |

|---|---|---|---|

| 2022 | January 24 | April 18 | No significant changes to the tax code. |

| 2023 | January 23 | April 18 | Continued implementation of the American Rescue Plan Act of 2021. |

| 2024 | January 22 | April 15 | No major tax law changes significantly impacting the filing process. |

Think of tax preparation as a marathon, not a sprint. Starting early, even before the official start date, can alleviate stress and ensure accuracy. Gather your documents, familiarize yourself with any changes in tax laws, and perhaps even consider seeking professional advice if needed. You’ve got this! Remember, a little preparation goes a long way towards a successful and less anxiety-inducing tax season.

Let’s conquer this together, one tax form at a time! This year, let’s make tax season less of a dreaded chore and more of a manageable process. You are capable and prepared. Believe in yourself and your abilities! Embrace the challenge and know that with organization and a positive mindset, you can navigate this process successfully.

Tax Filing Deadlines for 2025

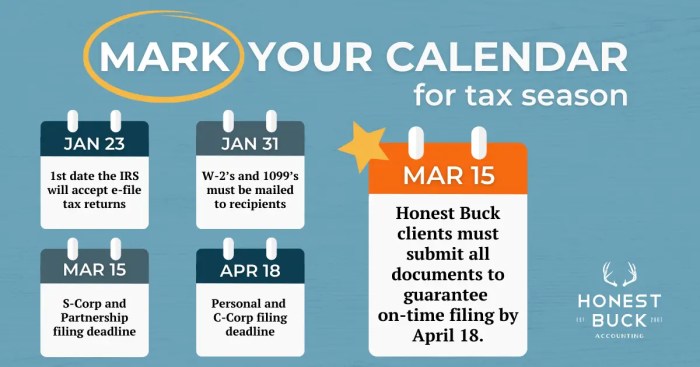

Alright folks, let’s talk taxes – a topic as thrilling as a root canal, I know. But hey, we’ve got to get this done, right? Knowing the deadlines is the first step towards a smoother, less stressful tax season. Think of it as conquering a mountain – one step at a time.The official tax filing deadline for individual income tax returns in 2025 is generally April 15th.

Mark it on your calendar, set a reminder on your phone, tattoo it on your arm – whatever works! This date, like a well-trained tax dog, sits faithfully at the end of the tax season, waiting for your return.

Exceptions and Extensions to the Tax Deadline

There are situations, however, where the April 15th deadline might not apply to everyone. Life, as we all know, throws curveballs. Understanding these exceptions can save you from unnecessary penalties. It’s all about navigating the system, not getting buried by it.

- Taxpayers living abroad: Individuals residing outside the United States generally have an automatic extension until June 15th. This is a welcome breather, considering the extra time it can take to gather documents and navigate international tax laws. Imagine the paperwork involved! It’s enough to make your head spin.

- Disaster Relief: If your area was hit by a federally declared disaster, you might be granted an extension. The IRS often provides additional time for filing and paying taxes in such circumstances. Think of it as a compassionate understanding of extraordinary circumstances. The IRS is more human than you might think.

- Automatic Extension Request: You can also request an automatic extension to file your return, pushing the deadline to October 15th. This doesn’t give you an extension to

-pay* your taxes, though – just to file. Think of this as a short reprieve, giving you more time to organize your financial information. It’s like buying yourself some extra time to tackle that mountain.

Remember, these are just common exceptions; always check the IRS website for the most up-to-date and specific information related to your situation. It’s worth the effort to ensure you’re on the right track.

Tax season 2025 is just around the corner, a time for careful planning and, let’s be honest, a little bit of mild panic. But amidst the paperwork, remember life’s little joys! For instance, keep an eye on the thrilling race for the top scorer in La Liga – check out the current standings at goleadores liga española 2024 2025 – and let that excitement fuel your tax preparation.

Remember, a well-organized tax return is a victory in itself, setting you up for a successful year ahead!

Penalties for Late Filing and Late Payment

Let’s be frank: missing the deadline has consequences. It’s not just a case of forgetting; there are financial penalties involved. Let’s face it, it’s best to avoid this altogether. Here’s the lowdown.

- Late Filing Penalty: The penalty for late filing is typically calculated as a percentage of the unpaid tax, increasing the longer you delay. Think of it as interest accumulating on a loan, only it’s the government’s loan to you – and they don’t take kindly to late payments.

- Late Payment Penalty: Similarly, there’s a penalty for late payment, also usually a percentage of the unpaid tax. This penalty is separate from the late filing penalty, so you could face both if you’re both late filing and late paying. Ouch! It’s like a double whammy.

- Additional Penalties: Depending on the severity of the delay and the circumstances, additional penalties may apply. This might involve interest charges, additional fees, or even legal repercussions in extreme cases. So, it’s best to make every effort to meet the deadline.

Think of it this way: promptly filing your taxes is like taking care of a small chore that prevents a much bigger headache later. A little planning and proactive action can save you significant stress and money. You got this!

Key Tax Changes for 2025

Navigating the tax landscape can feel like a thrilling adventure, sometimes a bit like a treasure hunt, and other times, a wild goose chase. But fear not, intrepid tax-filers! Let’s unravel some of the key changes for the 2025 tax season, making the journey a little smoother and perhaps even a tad more rewarding. Understanding these changes is your key to maximizing your refund or minimizing your tax burden.Let’s dive into the specifics.

Tax season 2025 is looming, a fact as unavoidable as the sunrise. While you’re wrestling with deductions, maybe take a quick break to admire the sleek lines of the upcoming 2025 Kia K5 – check out these stunning images: 2025 kia k5 images. Then, back to the nitty-gritty of those tax forms! Remember, planning ahead is key to a smoother, less stressful tax season, so let’s get organized and conquer those returns!

While precise details are always subject to final legislative action and potential adjustments before the official tax season, we can anticipate several areas of change that will significantly impact taxpayers. These adjustments aim to improve equity and efficiency within the tax system, and it’s important to be aware of them well in advance of filing.

Changes to Standard Deduction Amounts

The standard deduction, that helpful baseline for many taxpayers, is expected to see an adjustment. This annual update reflects inflation and aims to keep pace with the rising cost of living. For 2025, the anticipated increase will offer some welcome relief to individuals and married couples, potentially reducing the number of taxpayers who itemize. The precise figures will be released by the IRS closer to the tax filing season, but we can reasonably expect a notable rise compared to previous years.

This means many taxpayers might find themselves with a larger standard deduction, potentially simplifying their tax preparation process. For example, a single filer who previously relied on the standard deduction might see an increase of several hundred dollars, directly impacting their tax liability. This simple adjustment, though seemingly small, can make a significant difference in many households’ budgets.

Tax season 2025 is just around the corner, a time of both dread and (let’s be honest) mild panic. But before you dive headfirst into those forms, consider this: the upcoming changes to the ACT, as detailed in this helpful guide act changes explained 2025 shorter test , might impact your deductions if you’re claiming education expenses.

So, get organized, get informed, and conquer tax season 2025 with confidence! Remember, a little planning goes a long way.

Modified Child Tax Credit, Tax season 2025 start date

The Child Tax Credit (CTC), a cornerstone of tax relief for families, may undergo some modifications for 2025. While the core structure of the credit is likely to remain, there’s potential for adjustments to income thresholds or the maximum credit amount. These changes could impact families with varying incomes. For instance, higher-income families might see a slight reduction in the amount of credit they receive, while lower-income families might remain largely unaffected or even benefit from minor increases.

Imagine a family with two children; the modified CTC could slightly alter their refund, potentially increasing or decreasing it depending on their income level and the specific changes implemented. This illustrates the importance of staying informed about the exact modifications to this crucial credit.

Increased Tax Rates for High-Income Earners

Preparations are underway for potential adjustments to the tax brackets for higher-income earners. This shift aims to increase tax revenue and potentially fund important social programs. While the specifics are yet to be finalized, a shift in the top tax bracket is anticipated. This means individuals earning above a certain threshold could see a marginal increase in their tax rate.

For example, a high-earning entrepreneur exceeding the new threshold might experience a slightly higher tax burden on their income exceeding that limit. This is a change that directly affects those in higher income brackets, and careful planning is advisable for those who anticipate falling within this range. It’s crucial to consult with a tax professional to ensure accurate tax planning.

Tax Preparation Resources and Assistance

Navigating the world of taxes can feel like trekking through a dense jungle, but fear not! We’re here to equip you with the map and compass you need to conquer tax season 2025 with confidence and a smile (or at least, a sigh of relief). This section Artikels the various resources and assistance programs available to make your tax preparation journey smoother and less stressful.

Tax season 2025 is just around the corner, a time for careful budgeting and smart financial decisions. Speaking of smart decisions, have you considered upgrading your ride? Check out the projected jeep compass 2025 price – it might just be the perfect reward after conquering your tax returns. Remember, planning ahead for both taxes and big purchases ensures a smoother, more financially fulfilling year.

So, let’s tackle those taxes and then maybe treat ourselves!

Remember, you’re not alone in this!Let’s explore the wealth of resources designed to help you tackle your taxes effectively. From online tools to personalized support, there’s a solution tailored to your needs and comfort level.

Tax season 2025 looms, a yearly ritual as predictable as the changing leaves. But before you tackle those forms, consider a different kind of challenge: planning your training for the Berlin Marathon, if you’re thinking of running it; check out when the race is scheduled when is the berlin marathon 2025. After all, a well-planned marathon requires just as much preparation as a well-prepared tax return! So, let’s conquer both with gusto.

Remember, the tax season 2025 start date will be here before you know it.

Reliable Tax Preparation Resources

A multitude of resources are at your disposal to make tax preparation easier and more efficient. The IRS website, a cornerstone of tax information, offers comprehensive guides, forms, and publications. Think of it as your one-stop shop for all things tax-related. Additionally, various reputable tax software programs provide user-friendly interfaces and helpful guidance throughout the filing process.

These programs often offer features such as automated calculations, error checks, and direct e-filing capabilities. Finally, many professional tax preparation services are available, offering personalized assistance and expert advice for those who prefer a hands-off approach. Choosing the right method depends entirely on your individual preferences and needs.

Tax Assistance Programs

For taxpayers who need extra support, several valuable assistance programs are available. The Volunteer Income Tax Assistance (VITA) program provides free tax help to low-to-moderate-income taxpayers, people with disabilities, and limited English-speaking taxpayers. Think of VITA as a friendly neighborhood helping hand, offering free tax preparation and guidance. Similarly, the Tax Counseling for the Elderly (TCE) program offers free tax help for all ages, particularly those 60 and older.

TCE volunteers are specifically trained to assist with questions related to pensions and retirement-related issues. These programs are invaluable resources, offering not just tax preparation but also peace of mind. They’re a testament to the community’s commitment to supporting everyone through tax season.

Comparison of Tax Preparation Software

Choosing the right tax software can significantly impact your tax preparation experience. Here’s a comparison of three popular options, keeping in mind that features and pricing can change, so always check the latest information directly with the software providers.

| Software Name | Cost | Features | Pros and Cons |

|---|---|---|---|

| TurboTax | Varies depending on the version; free options available | Import from prior year, various support options, guided interview style | Pros: User-friendly interface, extensive features, strong customer support. Cons: Can be expensive for premium versions, some features might be overwhelming for basic filers. |

| H&R Block | Varies depending on the version; free options available | Guided tax preparation, audit support, mobile app accessibility | Pros: Easy navigation, good for both simple and complex returns. Cons: Can be expensive for premium versions, some features may require a paid subscription. |

| TaxAct | Varies depending on the version; free options available | Import from prior year, various support options, strong accuracy checks | Pros: Affordable options, comprehensive features. Cons: Interface might feel less intuitive than others, customer support may not be as readily available as TurboTax. |

Remember, taking proactive steps to prepare your tax documents and understanding your options for assistance will make the process significantly easier and less stressful. Embrace the opportunity to learn, seek help when needed, and navigate tax season 2025 with confidence and a clear understanding of the resources available to you. This journey, while sometimes challenging, ultimately empowers you with greater financial literacy and control.

Common Tax Filing Mistakes to Avoid in 2025

Navigating the tax landscape can feel like trekking through a jungle, especially with the ever-changing rules and regulations. A little misstep can lead to unexpected consequences, so let’s illuminate the path to a smoother tax season. Avoiding these common pitfalls can save you time, money, and a whole lot of headache. Think of this as your personal tax survival guide!

Inaccurate or Missing Information

Failing to accurately report income or deduct eligible expenses is a classic tax blunder. The IRS is meticulous; even small errors can trigger an audit. Incorrect Social Security numbers or missing W-2s further complicate matters, leading to delays in processing your return and, potentially, penalties. Let’s be clear: accuracy is paramount.

To avoid this, meticulously review all your tax documents. Double-check every number and ensure all necessary forms are included. Consider using tax preparation software to help catch errors.

Incorrect Filing Status

Choosing the wrong filing status – single, married filing jointly, head of household, etc. – significantly impacts your tax liability. Mistakes here can lead to an underpayment or overpayment, resulting in either a hefty bill or a smaller refund than expected. It’s crucial to understand the qualifications for each status.

Before filing, carefully review the IRS guidelines on filing statuses to ensure you select the one that accurately reflects your circumstances. If unsure, consult a tax professional.

Misunderstanding Tax Credits and Deductions

The tax code is complex, and many taxpayers struggle to understand the intricacies of available credits and deductions. Missing out on a valuable credit or incorrectly claiming a deduction can cost you a significant amount of money. For example, the Child Tax Credit has specific requirements, and improperly claiming it could lead to penalties.

Familiarize yourself with the various tax credits and deductions you may be eligible for. Utilize IRS publications and websites to learn the eligibility criteria and proper claiming procedures. Seek professional advice if needed.

Ignoring Estimated Taxes

Self-employed individuals and those with significant investment income are often required to pay estimated taxes quarterly. Failing to do so can result in penalties and interest charges. Underestimating your tax liability is a common oversight with serious financial repercussions. Remember, the IRS expects timely payments.

If you anticipate owing a substantial amount of taxes, plan for quarterly payments. Use tax software or consult a tax professional to estimate your tax liability accurately.

Failing to Keep Adequate Records

Maintaining organized and accurate records is essential for a successful tax filing experience. Poor record-keeping can lead to difficulty in reconstructing your income and expenses if an audit occurs. This can cause significant stress and delays in resolving any tax issues. It’s a preventative measure that saves a world of worry.

Maintain a well-organized system for storing all your tax documents, including receipts, bank statements, and tax forms. Consider using digital tools or cloud storage for easy access and organization. Remember, a place for everything and everything in its place!

Impact of Economic Factors on Tax Season 2025

Navigating tax season 2025 will be a journey shaped significantly by the economic winds blowing around us. Inflation, interest rates, and overall economic growth will all play a crucial role in how we approach our tax preparation and the ultimate tax burden we face. Understanding these influences is key to a smoother and more financially sound tax season.The economic landscape of 2025 will undoubtedly impact tax preparation and filing.

High inflation, for example, means the cost of goods and services has increased, potentially leading to higher deductions for some taxpayers. Conversely, increased interest rates can impact investment income and mortgage interest deductions. These fluctuating economic conditions create a dynamic environment where careful planning and accurate record-keeping become even more important. Think of it like this: the economic terrain is constantly shifting, requiring us to be nimble and well-equipped.

Inflation’s Impact on Tax Liability

Inflation’s effect on tax liability is multifaceted. While higher prices might seem to reduce purchasing power, they also influence several tax-relevant aspects. For instance, the standard deduction amounts are adjusted annually for inflation. This means that taxpayers may find their standard deduction increased, potentially lowering their taxable income. However, inflation also affects income levels, meaning higher wages might put some individuals into higher tax brackets, offsetting the benefit of a higher standard deduction.

Let’s imagine a scenario where Sarah, a teacher, receives a raise to account for inflation. While her salary is higher, the actual purchasing power of that increase may be minimal, yet she may find herself in a higher tax bracket and owing more. Conversely, if Bob, a small business owner, experiences increased costs due to inflation, he may be able to deduct these increased expenses, reducing his taxable income.

Interest Rates and Their Tax Implications

Interest rates significantly influence investment income and deductions. Higher interest rates generally mean higher returns on savings accounts and investments, resulting in increased taxable income for those with significant investment portfolios. However, the flip side is that higher interest rates can also impact mortgage interest deductions. Homeowners with larger mortgages might see a larger deduction, offering some offset to the higher interest payments.

Consider the case of Maria and David, who purchased a home in 2020. With rising interest rates, their mortgage interest deduction might be larger, providing some relief. Conversely, John, who invested heavily in bonds, may see a higher tax liability due to increased interest income from his investments. The impact of interest rates varies significantly depending on individual financial circumstances.

Economic Impact Across Income Brackets

The economic shifts affecting tax season 2025 will disproportionately impact different income brackets. Higher-income earners, with larger investment portfolios, might see a greater increase in taxable income due to higher interest rates. Conversely, lower-income earners might face challenges from increased costs of living, potentially exceeding any benefits from increased standard deductions. This isn’t to say that everyone in a lower bracket will be negatively affected, but it highlights the nuanced nature of the situation.

For instance, a family relying heavily on government assistance programs might see minimal impact from increased interest rates, while a family relying solely on income from investments could see a significantly larger tax burden. This underscores the importance of personalized financial planning and seeking professional advice.

Tax Strategies for Navigating Economic Uncertainty

Preparing for tax season 2025 requires proactive financial planning. Careful record-keeping of all income and expenses is crucial. Consulting with a tax professional can help taxpayers understand the implications of economic changes on their specific financial situation. This proactive approach will not only help individuals minimize their tax liability but also offer peace of mind during these uncertain times.

Remember, knowledge is power, and being informed empowers you to make the best financial decisions for your future. Think of it as a financial adventure – and with the right preparation, you can navigate the challenges and reach your financial destination with confidence.